Investor Letter

May 2025

Dear Investors,

We are pleased to share our latest investor letter, highlighting two current platform investments that illustrate Attalis Capital’s investment philosophy and differentiated sourcing strategy.

Journal Entry: Kinder Australia - Bulk-Material Conveyor-Belt Consumables

In May 2025, a consortium led by Attalis Capital, with backing from the Victorian Business Growth Fund (managed by Roc Partners), and management, acquired 100% of Kinder Australia, an engineering-led supplier of mission-critical conveyor consumables. Kinder operates at the intersection of productivity and preventative maintenance across mining, quarrying, grain-handling and construction. Its products extend conveyor life, reduce dust and spillage, and help avoid costly operational downtime.

Investment Thesis

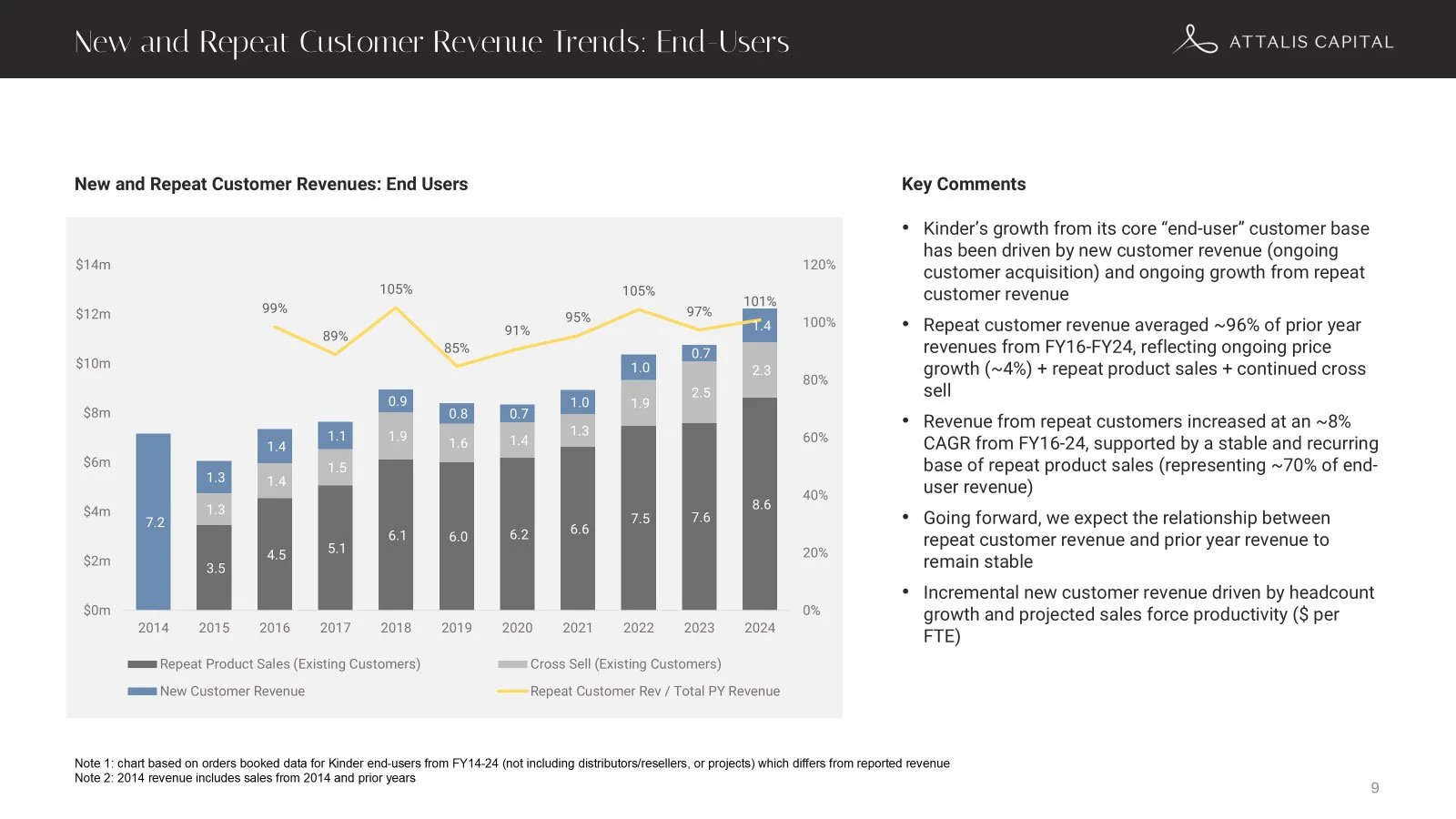

Kinder represents a classic razor/razor-blade model. Bespoke installations drive recurring demand for high-margin consumables—such as belt skirting, seal systems and wear liners—that are replaced on cycle. Repeat end-user revenue has averaged approximately 96% of the prior-year base over FY16–24, with positive net-revenue cohort growth.

The business benefits from:

Deep customer relationships: Over 40% of customers have purchased from Kinder for more than a decade, underpinning revenue resilience and forward visibility

Proprietary IP and high switching costs: Registered designs such as Snap-Loc® and Superskirt® offer differentiated performance and entrench customer retention

Attractive unit economics: Core-product gross margin of ~48%, FY24 EBITDA margin of 19.7%, and maintenance capex of ~1% of revenue support strong free cash flow conversion

Multiple growth levers: Pricing optimisation, product bundling, bolt-on acquisitions, range extension and geographic expansion (notably Western Australia)

The transaction completed without debt. The consortium’s entry valuation of ~3.9 × FY25F EV/EBITDA offers compelling free-cash-flow yield, dividend potential and meaningful scope for multiple re-rating as the platform scales.

Alignment with Attalis Capital’s Investment Principles

Simple and understandable business model

Razor/razor-blade model with 96% repeat revenue (FY24). Custom engineering enhances pricing power while maintaining operational simplicity

Formidable barriers to entry

Proprietary IP and >10-year customer tenures for 40% of the base creates high switching costs and defends against low-cost competition

Simple, predictable and free-cash-flow generation

19.7% EBITDA margin, <1% maintenance capex, limited working capital swings and consumables-led revenue creates resilience across cycles

Catalyst for value creation

SAP ERP system enables dynamic pricing, inventory optimisation and smooth integration of bolt-ons; near-term expansion opportunities in WA and new distributor channels

Growth tailwind

Rising bulk volumes and tightening ESG/OH&S regulation support demand for Kinder's dust, spillage and noise control products

Attractive valuation and asymmetric return profile

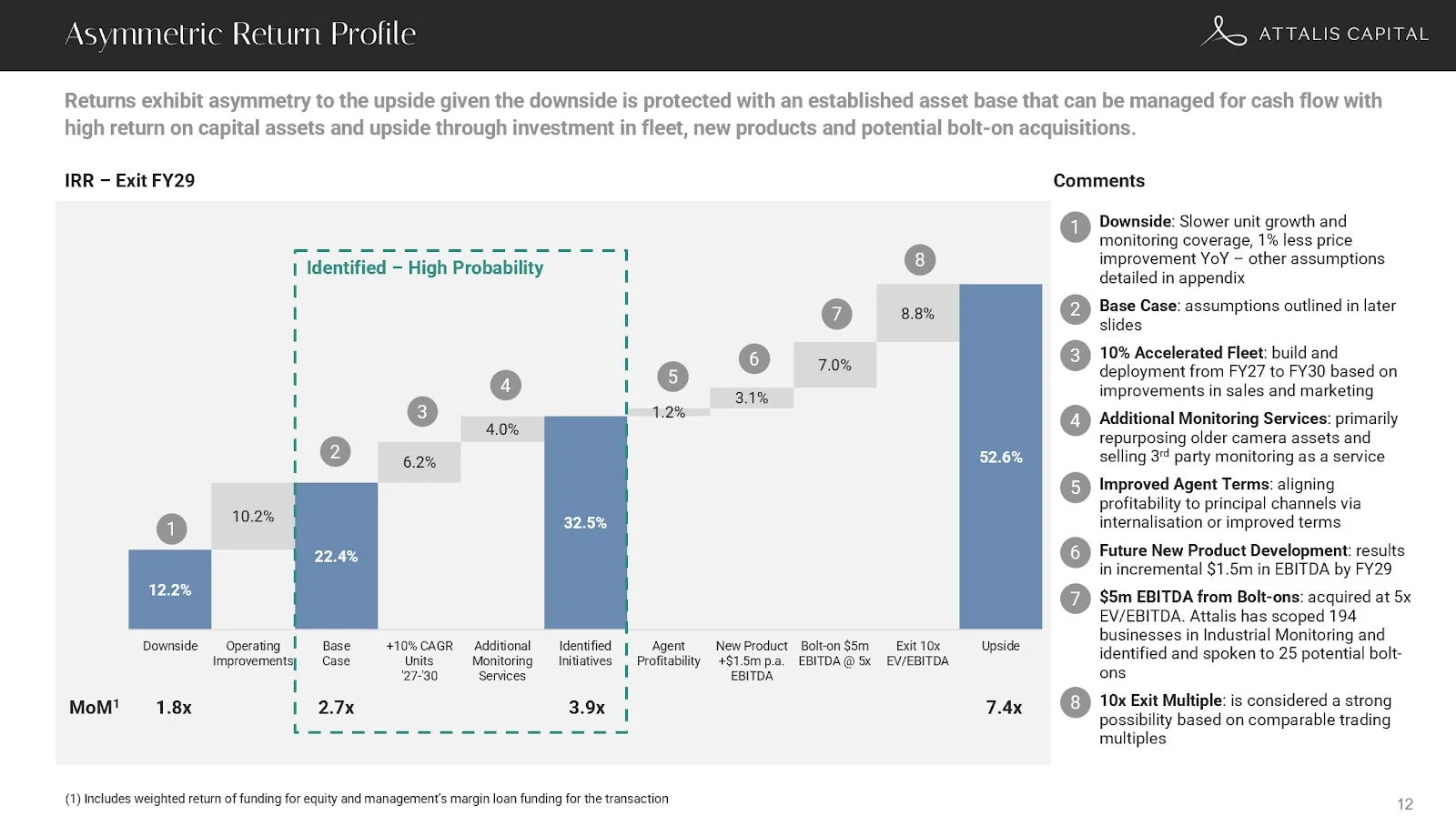

Entry at 3.9 × EBITDA vs listed peers at 6–7 × provides a valuation buffer; base-case IRR >25% underpinned by cash flow and strategic M&A

Exceptional management and governance

MD Charles Pratt retains ~21% equity; senior team holds 9%; planned CFO appointment to strengthen governance

Lex Scott-Mackenzie will join the board alongside Attalis and Charles. Lex brings a wealth of industry and financial experience from his time at Macquarie Bank, including overseeing its investment in Uon, a leading provider of water and energy solutions to the mining industry

Limited exposure to extrinsic factors

Revenue is tied to production volume, not commodity prices; customer base is diversified across iron ore, lithium, aggregates and grain; coal accounts for only ~4% of FY24 revenue (ex-projects)

Strong balance sheet and conservative leverage

Transaction closed debt-free; ANZ facility reserved exclusively for bolt-on acquisitions

Vision Intelligence - Market Leader in Remote Industrial Monitoring

Attalis Capital is in the final stages of closing its next platform investment, Vision Intelligence. All definitive agreements including the Share Sale Deed were executed last week. Cornerstone commitments are now in place from an Australian superannuation fund, a number of family offices and strategic investors covering a significant portion of the A$50 million raise. Financial close is June 2025.

Vision is the clear market leader in solar-powered, industrial-grade remote monitoring across Australia and New Zealand. The business integrates proprietary hardware, IoT sensors, a 24/7 ASIAL-certified command centre and a data platform processing ~3 million hours of footage each month.

Of the 3,896-units in its mobile fleet, 3,095 are currently on hire, giving a blended utilisation of 79%. This headline rate is diluted by the recent expansion of new solution lines (e.g. RegCheck, Capture, EnviroGuard) that are still ramping up and some turnaround agent performance; core security cameras (V4 and V8) continue to run at a robust 91% utilisation in principal branches. The fleet generates ~87% recurring revenue and delivers a 23% return on capital employed.

Operational Momentum

Strong financial performance: Nine months to March 2025 revenue of A$19.0 million (+8% YoY) and operational EBITDA of A$6.2 million at a 33% margin, both ahead of budget; March 2025 set a record with A$2.3 million revenue

Sales traction: First outbound campaign post-exclusivity lifted units on hire by 11% in five months

Network enhancement: Auckland branch converted from agent to principal model, improving growth velocity and service quality

Specialist fleet growth: Value-Add Solutions fleet expanded 130% YoY, achieving an annualised A$2 million in revenue

Monitoring uptake: Continued adoption of Vision’s 24/7 monitoring services through its ASIAL-graded monitoring centre achieving an annualised A$2.1 million revenue (+61% YoY)

These initiatives, combined with the structural shift from manned guarding to AI-enabled, ESG-compliant monitoring, expand VI’s addressable market to A$0.8–1.2 billion—two-thirds of which lies outside construction. Downside risk is underpinned by a hard-asset fleet and 90% customer retention. Upside potential is driven by subscription compounding, fleet expansion and bolt-on acquisitions.

Transaction Update

Due diligence: Comprehensive legal, technical, financial and commercial due diligence completed

Legal: All diligence streams are now closed and transaction documents - the Share Sale Deed, Shareholders’ Agreement and all ancillary deeds - have been fully executed. Completion is contractually fixed for 23 June 2025

Debt financing: Westpac credit-approved term sheet executed; facility on track for final approval prior to completion

Equity raising: Cornerstone commitments secured; remaining allocations available on a first-come basis prior to end of June close

Alignment with Attalis Capital’s Investment Principles

Simple and understandable business model

Transparent day-rate plus subscription model drives 87% recurring revenue and predictable cash flows

Formidable barriers to entry

Only vertically integrated ASIAL C2-graded operator in AU/NZ; proprietary 3,800-unit solar fleet and growing data set create high replication barriers

Simple, predictable and free-cash-flow generation

33% EBITDA margin, 23% ROCE and short payback periods (6–25 months) underpin efficient capital deployment

Catalyst for value creation

Sales acceleration, branch integration, disciplined fleet deployment and monitoring mix shift already visible in results; each A$1 million of fleet contributes ~A$0.6 million EBITDA and up to A$5.6 million EV

Growth tailwind

Secular shift from manned guarding to automated monitoring driven by labour scarcity, ESG mandates and AI adoption; TAM of A$0.8–1.2 billion, 66% outside construction

Exceptional management and governance

Founders are rolling meaningful equity and injecting new capital; 15% ESOP and management margin loan terms reinforce alignment

Limited exposure to extrinsic factors

Revenue is OPEX-tied and often rises during downturns; customer base spans mining, infrastructure, agriculture and government; construction sector is now <40% of revenue; pro forma leverage capped at 1.9 × EBITDA

Compounding effect of high ROCE

Unit-level ROCE of 21–81%; fixed-cost monitoring centre enables scalable margin expansion and self-funded growth

Attractive valuation and asymmetric return profile

Entry at 6.5 × steady-state EBITDA offers downside protection relative to listed IoT peers, with scope for 4-7× MoM and >50% IRR through organic growth, multiple re-rating and bolt-ons

Vision Intelligence exemplifies Attalis Capital’s approach: proprietary sourcing, close management alignment, and a rigorous focus on capital preservation with asymmetric upside. If you would like to review the full investment deck, please let us know.

Although we are not in the business of macro forecasting or market timing, we think carefully about how changes in global policy, tariffs and supply chain dynamics may influence downside risk and the durability of each platform’s growth tailwind. This lens reinforces our preference for mid-market, domestically focused businesses with high repeat revenues and straightforward supply chains. It also highlights how structural shifts—such as the growing demand for platforms like Vision Intelligence (integrated hardware, proprietary software and ASIAL-graded remote monitoring)—are increasing the value of businesses that capture, process and interpret data to deliver timely, actionable insights to customers.